A World With No Center

In high fashion or high finance, leadership gravitates to a few capitals. Paris and Milan house the couture CEOs, and Wall Street or the City of London concentrate banking’s power players. Luxury hospitality couldn’t be more different. It’s a constellation of executive talent spread across multiple hubs, or sometimes no hub at all. It is perhaps the most geographically decentralised consumerfacing sector. Unlike fashion houses anchored in Paris or Milan, or real estate private equity focused in New York and London, hotel companies have C-suites scattered from Geneva to Dubai to Dallas. No single city holds the crown as “capital of hospitality,” and that global spread of leadership is built into the industry’s DNA.

Why So Fragmented?

The reasons are rooted in ownership and history. Ultrawealthy individuals and sovereign funds invest in trophy hotels and often base their ventures wherever they please – be it their home country or a tax-friendly haven. One brand might run operations from Montréal, while another launches from Mauritius. Even the giants have been on the move: in recent years some hotel groups have uprooted headquarters from traditional centres (London, New York) to Switzerland, Miami, or Dubai in pursuit of lifestyle and tax advantages. The result? A decentralised leadership landscape where top executives can be found in every corner of the globe, and talent pools are far more dispersed than in industries like banking or fashion.

No One-Size-Fits-All Pay

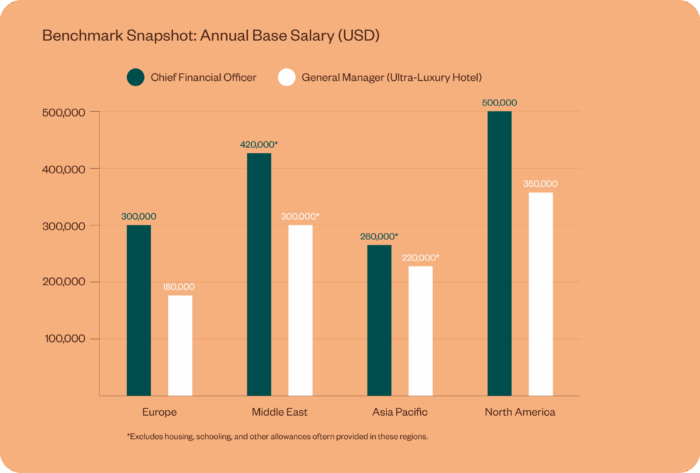

This fragmentation has profound effects on how leaders are paid. Compensation packages vary wildly by geography and role, reflecting both fierce global competition for talent and local market nuances. A luxury hotel company can’t copy-paste a Wall Street pay scheme and expect it to fly in Bali or Riyadh. Base salaries, bonuses, long‑term incentive plans, and perks are calibrated to each context. A U.S. General Manager might earn double the base salary of a peer in Europe, while a counterpart in Asia could draw a higher base but a smaller bonus, offset by benefits such as housing, schooling, and flights home. Even at corporate HQ, regional differences abound. A Chief Financial Officer in London or New York would consider housing allowances exotic, but in the Middle East or Asia those perks are often standard. And while a European executive might enjoy 30 days of holiday, their American peer is lucky to get 15. The key is that each region’s talent market and lifestyle expectations demand a tailored approach.

The Art of the Package

In such a fragmented, competitive arena, crafting an executive pay package becomes a high-stakes art form. It’s not just about numbers on a contract – it’s about understanding an executive’s motivations and what they’re leaving behind. Top candidates today weigh the opportunity cost of moving: invested stock, the annual bonus at their current firm, the upheaval for their family. To tip the scales, hotel companies have gotten creative. Sign‑on and guaranteed bonuses have surged – the incidence of offers with sign-on incentives has risen more than 450% since 2020 – aimed at making a new hire “whole” for any bonus or equity they forfeit by switching jobs. Likewise, if luring an executive from a comfortable post in one country to a new opportunity in another, every detail counts: covering relocation costs (often tens of thousands of dollars for movers, visas, and tax advisors) is now standard practice, and bespoke sweeteners like extra paid leave, club memberships, or even paid spousal support have entered the negotiation lexicon. The best compensation strategies blend data and personalisation – part science, part art – to hit that talent sweet spot.

Article by Christina Reti for Asia Pacific Hotels Monitor

Issue 12 – November 2025

Published by White Bridge

Reach out

"*" indicates required fields